to be TRULY “Mobile-First", we needed to make it possible to open an account within the native app

When I first joined Capital One's Growth team, the only way to open a checking or savings account was to do it on the web and then go to the mobile device to access your new account. With the national marketing campaign preparing to push both the mobile features AND the ability to open an account “in under 5 minutes,” there was a considerable amount of pressure on our team to deliver.

Creating a Red Carpet Experience for Existing Customers

Problem:

Many Credit Card customers were already using the native app, and many of them weren't aware of the bank offers. The national ads were about to change that awareness, but we needed to make it easy for those existing customers to open a new account right there in the app instead of having to visit the website first.

Solution:

For existing customers, we could bypass all of the data entry for the application flow given that we already knew them. We could drastically cut the opening time by simply confirming their existing info and then having them review and sign the Terms & Conditions.

Results:

That little “Open a New Account” button was a pretty big deal. It required close coordination with our Enterprise and LOB product partners to get approval and understanding that the Bank experience would happen on the device, whereas other LOBs would continue to operate through a web-view.

But more importantly, for thousands of customers who saw the national ads, they had the power in their hands to open up a checking or savings account in under five minutes. In fact, given they already had their info on file, the new accounts took around three and a half minutes to open.

Then, we made it mobile-first for everyone, even new customers

We had built the red-carpet experience on Android because our engineering team was further along with the tech needed for account opening. But once we got it launched, we quickly began building it out for iOS.

But where it really all came together, was when we made the product selection and account opening available for first-time users of the app. Now, the vision of a mobile-first experience could be truly realized. A non-customer could download the app and begin the process right there, without having to bounce to the web.

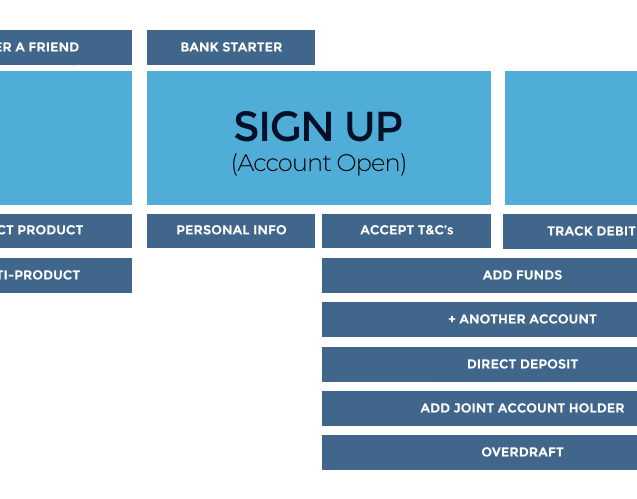

Modularity is where the magic happens

Once our team solved the mobile-first puzzle, we turned our attention to making the extremely long account opening form a better experience—for the customer and for the business. Even though previous teams had done a great job at breaking up the process into six distinct parts, sections like the personal information page got even longer as the user answered a few questions. Our team instinctively knew that filling out personal information on a bank application can be intimidating on its own. But the experience on mobile—when a user is out and about or simply struggling to read and type on a tiny keypad—can be sub-par from the get-go.

Problems For The Customer:

Listening to hundreds of customers in qualitative studies, we learned that it's not just how MUCH is being asked, but WHAT is being asked of them, and WHY are we even asking for that info?

And we learned that the order of questions made a difference, we needed to ascertain which one might be the most effective overall.

Qualitative studies and call center feedback were helpful, but we needed to create an experience where calling in for help was not necessary in the first place. To be truly helpful to our customers, we needed to be able to A/B test different configurations and language in production, and gain insights from real-time data.

The Long Form: While the form was broken up into several big segments, there was still no way for our business and team to tell where customers might be struggling or abandoning the experience on pages like the personal info section.

Solution:

By breaking up the form into smaller pieces, we could change the language to be more helpful and reassuring at those sticky points. And where needed, we could even add optional information in the form of tooltips that answered common questions along the way.

The steps progress bar (which was there before, but a different design) now moved in proportion to the percentage of the form completed/remaining in a way that provided some reassurance to the customer as to how much time the process would take.

RESULTS:

We saw a massive improvement in completions per app-start. And we were also able to reduce the time it took customers to complete the form.

The modular nature of the experience allows the optimization to continue. So, as regulations and requirements may change, it's possible to respond and gauge the impact.

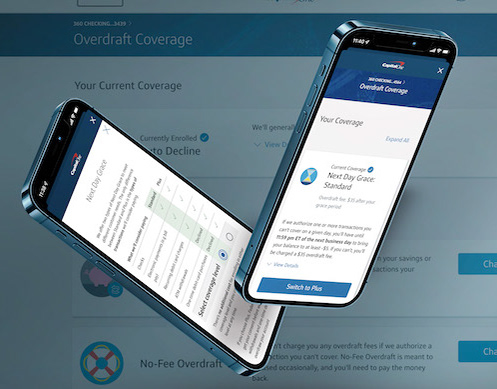

Our ability to A/B test the variations also provided another key benefit: We were able to test bringing parts of the onboarding process forward into the application flow. This allowed us to improve rates of funding on account opening without compromising the completion rates or the timing, and to encourage users to complete setup tasks such as setting their overdraft preferences or setting up direct deposit.

My Big Takeaways from this work

There's nothing like working with a world-class team of engineers who can work magic with code. But even more than that, I experienced the power of inclusion—bringing engineers, product folks, and front-line associates into the design and research process. There were many times when our user labs lead would comment on how we'd fill the room during the qualitative interviews. I recall the excitement in the room as the engineers had the opportunity to see the impact of their work on the customer and hear their feedback firsthand. And their contributions to the synthesis were always strengthening.

Storytelling matters. Just as bringing others into the design process can improve the quality of the work and process, it is important to broadcast the story of the work internally. Especially in a matrixed, large organization. The story that my team and I were telling about account opening evolved over the years as we explored, tested, and learned more. It was critical to keep our line of business and enterprise partners informed and engaged as there were (and still are) many parallel lines of work happening on related experiences.